Lite Developer's guide

The iVeri range of payment solutions, developed by iVeri Payment Technologies (Pty) Ltd provides proven credit card payment solutions for businesses that have online or physical presence. LIte is an online payment product.

Overview

Overview of iVeri Lite - The Hosted Payment Page

The iVeri Lite hosted payment page is an ecommerce solution designed for merchants who want to accept card payments in their online stores. The iVeri Lite hosted payment page can be integrated in one of three ways:

- Full Redirect -

A full Redirect to

the Hosted payment page shifts the interaction of the shopper/buyer away from

the merchant’s website and only goes back to the merchant website when the

transaction is complete.

- LiteBox - The LiteBox hosted payment appears or pops up within the merchant’s website, the merchant’s website remains unchanged, providing for a more user friendly and seamless checkout experience for both cardholder and merchant.

- Shopping Carts - The iVeri Lite hosted payment page is integrated to some of the commonly used shopping carts.

The types of cards, transaction types,

and payment methods accepted depend on the acquiring bank and merchant

agreements.

Payment Features

Depending on the acquirer involved, iVeri Lite has the capacity to offer the following payment methods:

Card:

- VISA

- MasterCard

- AMEX

- Diners

- UPI

Mobile Money

- EcoCash

- M-Pesa

Additional payment methods:

- MasterPass

- Visa Checkout

- Visa Account Funding Transactions

- Mastercard Funding Transactions

Account-to-Account Transfer:

- Ozow

Other functionalities available:

- 3DSecure: iVeri Lite, being an e-commerce product, allows for 3DSecure protocol for payer authentication in online transactions, if configured accordingly.

To learn more about 3D Secure, visit this page. - Fraud Management

- Transaction history reporting

- Merchant Portal - BackOffice: Merchant Portal includes features that are merchant-specific such as reporting, payment page customization, and general configurations. More on iVeri Lite BackOffice features can be found on this page

iVeri Lite Process Flow

iVeri Lite requires very little integration and is aimed at Internet merchants who have limited technical resources. Lite transactions are processed on a web site and secured via an SSL certificate without the merchant having to buy SSL since iVeri lite takes care of it on their behalf. Although ideal for websites with small catalogs, iVeri Lite still provides a powerful processing engine.

Process Flow

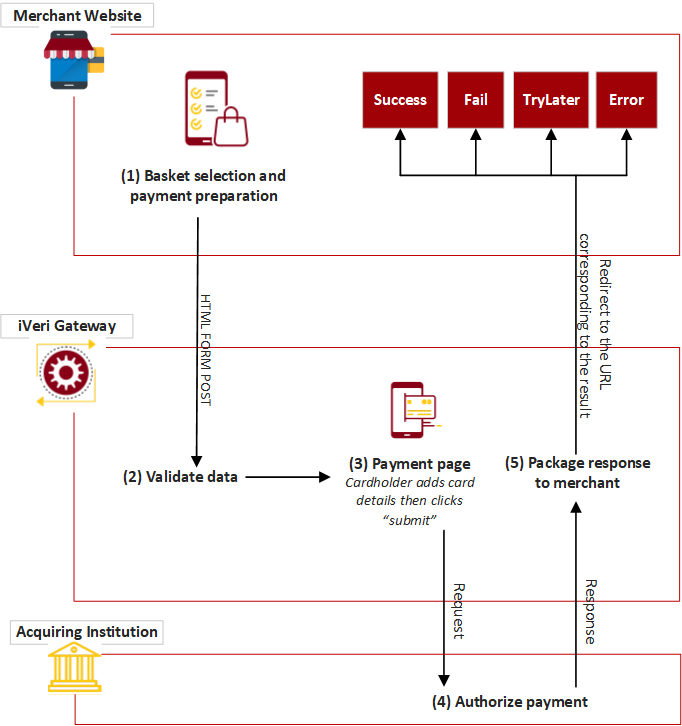

This diagram illustrates the flow of events of an iVeri Lite transaction:

Process Flow Description:

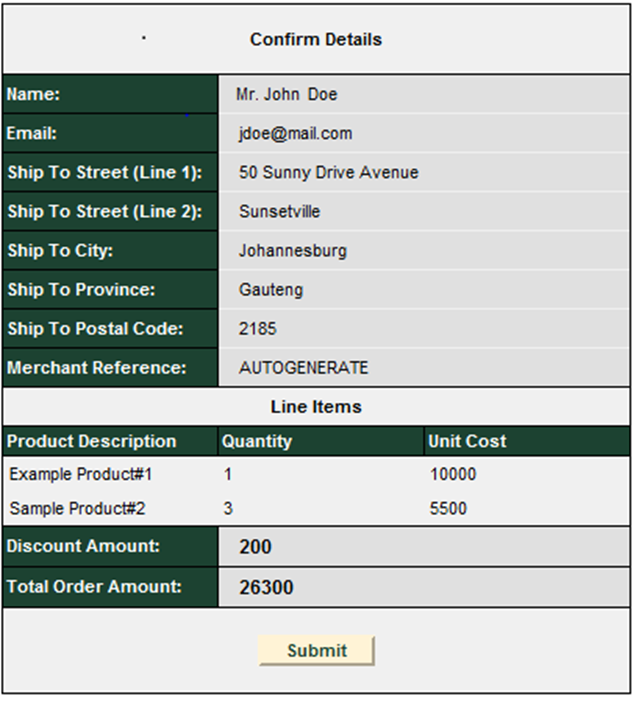

(1) The cardholder is at the point in the purchase process where the basket has already been selected and he is now on the brink of paying for it. The website thus knows the price of the basket, the Invoice Number (the merchant could also have iVeri BackOffice allocate the Invoice number for them by using the “AUTOGENERATE” option) .

(2) Once the “Submit” button has been clicked, the customer’s captured details are sent to the Gateway verifying that the ApplicationID is valid, validating the variables i.e. purchase amount is an integer and that all required fields have been populated.

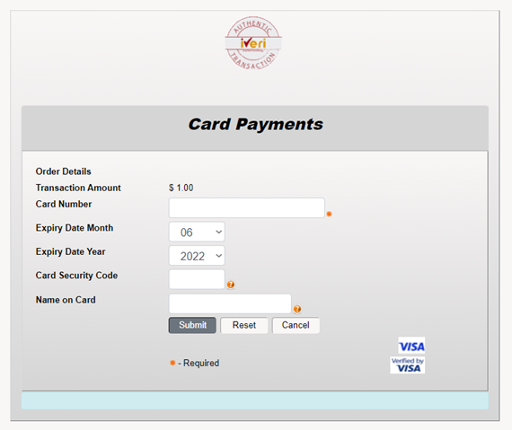

(3) The customer’s card details are captured on a SSL secured website where, after clicking on the Submit button, validation of the entered values (i.e. credit card number, expiry date…) will take place. Once validation has succeeded a “Please wait ......” message is returned to the cardholder while the transaction is in process

Authorization is performed at the respective acquiring financial institution/department who will then interact with the issuing financial institution/department.

(4) The return of an authorization can be either of the following:

successful, failed, system error or please try again later.

A redirect is sent to the cardholder’s browser telling it which Result URL to display.

(5) In the event of a successful/error transaction the cardholder as well as the Merchant can be emailed a statement indicating the successful completion of the transaction. Those transactions can be tracked via the BackOffice.

(6) A success/error page is returned to the cardholder by the merchant to show the transaction type, transaction amount, authorization code, merchant reference and purchase date

Getting Started With Lite

Registering as a merchant

Merchant account can be attained by registering with an acquiring bank, a list of which can be found on this page

Development phase

At this stage you will proceed with development based on the integration method you have selected, and may reach out for your contact at the acquiring bank if you require support.

Test phase

The iVeri Gateway provides a mechanism where a merchant can

perform test transactions that are routed to an iVeri Gateway issuer simulator.

This enables a merchant to complete testing within the test environment. When

the merchant is ready to process LIVE transactions, the acquiring bank can

activate the merchant profile for LIVE processing which will be routed to the

genuine card issuer.

When performing a test transaction, using your Test Application

ID, the following credit card numbers must be used, based on whether 3DS is

enabled, and the MPI (3DS Provider) at play:

Non-3DS iVeri Gateway test cards:

Card Number |

Result Status |

Result Description |

4242424242424242 |

0 |

“” |

2121212121212121 (Randomly returns one of 3 results) |

3 |

“Hot Card” |

4 |

“Denied” |

|

5 |

“Please call…” |

|

5454545454545454 |

9 |

“Unable to process” (times out) |

Any other card number |

14 |

“Invalid card number” |

BANKSERV (3DS 2)

|

Frictionless Full Authentication |

|

|

Scenario 1 |

Authenticated Frictionless Transaction |

|

Test Values |

Visa: 4069425217889137 MasterCard: 5163426869252246 |

|

Failed Frictionless Authentication |

|

|

Scenario 2 |

Failed Frictionless Transaction |

|

Test Values |

Visa: 4069421358347845 MasterCard: 5178872338408971 |

|

Challenged Full Authentication |

|

|

Scenario 3 |

Authenticated Challenged Transaction |

|

Test Values |

Visa: 4895749143709709 MasterCard: 5192602720584796 issuer ACS Password: test123 |

CYBERSOURCE (3DS 2)

|

Frictionless Full Authentication |

|

|

Scenario 1 |

Successful Frictionless Authentication |

|

Test Values |

Visa: 4456530000001005 MasterCard: 5200000000001005 |

|

Failed Frictionless Authentication |

|

|

Scenario 2 |

Unsuccessful Frictionless Authentication |

|

Test Values |

Visa: 4456530000001013 MasterCard: 5200000000001013 |

|

Challenged Authentication |

|

|

Scenario 3 |

Successful Step-Up Authentication |

|

Test Values |

Visa: 4456530000001096 MasterCard: 5200000000001096 |

The Card Security Code (CVV) Field can be kept empty or set to any three numbers for testing purposes.

If you want to generate the error “Invalid Expiry Date”, make the expiry date in the past.

Live phase

Before the merchant can start doing Live transactions, the acquirer or iVeri must validate that their implementation is correctly completed. For that purpose, the merchant shall send a request via email to the acquirer contact (available here) once they have completed their implementation, and after they have tested in the Test environment, while providing the following:

- Merchant's Website URL

- User Group Number / Merchant number

- Test login credentials (Username / Password) for logging in to the merchant website as an end-user (if applicable) NB: It is time consuming for our test team to register as users on each website that we have to test hence this is required by them. If no log-in required, please state so within your email.

Instruction on how to buy products from your website.

Once the integration has been validated, the acquirer will enable the live ApplicationID. At this point, the merchant must replace the test ApplicationID used during testing with the live ApplicationID and deploy the code into the merchant’s production environment.

Gateway Addresses

Nedbank Gateway – Applicable for Nedbank acquired merchants located in South Africa, Zimbabwe, Namibia, Lesotho and Swaziland

|

Website |

URL |

Port |

|

BackOffice |

443 |

|

|

Lite |

|

|

|

Authorization Information |

|

CIM Hosted Gateway – Applicable for merchants acquired by CIM Finance in Mauritius

|

Website |

URL |

Port |

|

BackOffice |

443 |

|

|

Lite |

|

|

|

Authorization Information |

|

CSC Hosted Gateway – Applicable for merchants that acquired by banks affiliated to CSC

|

Website |

URL |

Port |

|

BackOffice |

443 |

|

|

Lite |

|

|

|

Authorization Information |

|

Hosted Gateway – Applicable for merchants based in Kenya, Zimbabwe, Mauritius, Angola, Ghana

|

Website |

URL |

Port |

|

BackOffice |

443 |

|

|

Lite |

|

|

|

Authorization Information |

|

If you are not sure which of the Gateway addresses applies to your merchant account, please refer to your acquiring institution for confirmation.

Integration Methods

General Requirements

iVeri Lite implementation consists of doing a submission of a form post to the Gateway endpoint while including all required/mandatory parameters.

Applicable Parameters to be passed in the request are common to all the integration methods supported on iVeri Lite, and elaborated in this documentation.

The list of applicable parameters can be found here

Full Redirect – Hosted Payment Page

LiteBox Hosted Payment Page

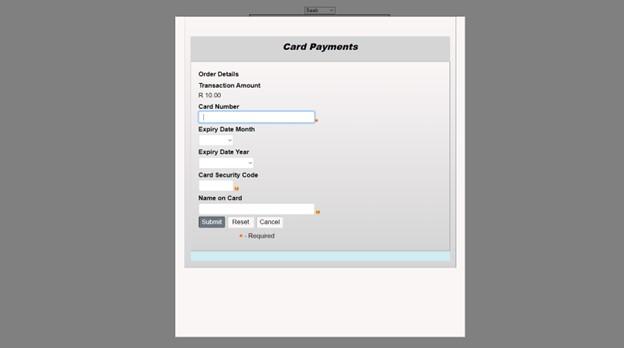

The LiteBox hosted payment page is an e-commerce solution that allows merchants to connect, send payment requests to the iVeri Payment Gateway without redirecting the cardholder away from their website. When implemented, the LiteBox pops up and sits in-front of the merchant’s website. From a merchant/cardholder point of view the LiteBox solution provides a more seamless checkout experience.

Merchants’ developers can download the JavaScript library that handles the events to generate the button. The library can be found on the following URLs:

For Nedbank acquired merchants located in South Africa, Zimbabwe, Namibia, Lesotho and Swaziland: https://portal.nedsecure.co.za/scripts/jquery/js/jquery.litebox.js

For merchants based in Kenya, Zimbabwe, Mauritius, Angola, Ghana:

https://portal.host.iveri.com/scripts/jquery/js/jquery.litebox.js

For merchants acquired by CIM Finance in Mauritius: https://portal.merchant.cim.mu//scripts/jquery/js/jquery.litebox.js

For merchants that acquired by banks affiliated to CSC: https://portal.cscacquiring.com/scripts/jquery/js/jquery.litebox.js

If you are not sure which of the URLs applies to your merchant account, please refer to your acquiring institution for confirmation.

LiteBox Implementation Steps:

Step One: In order for the LiteBox to render correctly to the device being used and to connect to the appropriate gateway end point the below must be defined on the head tag

NB: replace “[endpoint]” with the appropriate gateway address

Step Two: Place the LiteBox button to be used to trigger the LiteBox page in the body tag, the merchant developer can set the color, and the label of their own choosing for the button. Download the JavaScript library that handles the button on https://[endpoint]/scripts/jquery/js/jquery.litebox.js . Also, to note is that the jQuery uses an id attribute on the HTML elements.

Step Three: Initialize the LiteBox. Define event handlers for the data that is to be returned from the gateway and when the LiteBox closes.

Step Four: Data returned to the merchant is JSON formatted The following parameters are some of the data elements returned to the merchant, some of which will only be returned if present in the request message. Data parameters that can be passed to the iVeri gateway as part of the transaction request can be referenced in 8.2 iVeri Lite Specification

- Lite_Merchant_ApplicationId

- Lite_Merchant_Trace

Ecom_Payment_Card_Number - Ecom_Payment_Card_ExpDate_Month

- Ecom_Payment_Card_ExpDate_Year

- MerchantReference

- Lite_Order_Amount

- Lite_Order_Terminal

- Lite_Order_AuthorisationCode

- Lite_BankReference

- Lite_TransactionDate

- Lite_TransactionIndex

- Lite_Payment_Card_Status

- Lite_Result_Description

Shopping Carts

iVeri Lite plug-in is available for download for the following Shopping Cart platforms:

WooCommerce: https://www.iveri.co.za/docs/woocommerce-6

OpenCart:

https://www.iveri.co.za/docs/opencart-14

VirtueMart:

https://www.iveri.co.za/docs/virtuemart-15

Parameters

The following parameters are expected in the form submitted to the Gateway at step 3 of the iVeri Lite process flow and/or returned by the Gateway in the response at step 6 to the cardholder via the merchant's website.

Note: Not all of the fields in this specification are mandatory.The list of parameters below has been split to reflect mandatory and optional data.

You can simulate a test form post, using data corresponding to your request, on this link

Mandatory Parameters:

Name |

General Description |

Length |

Notes |

Lite_Merchant_ApplicationId |

iVeri Application id |

36 |

Allocated to the Merchant during registration |

Lite_Order_Amount |

Amount to authorize |

10 |

The total amount for the order including tax in cents. This must be equal to the sum of the lineamount*linequantity for each line item |

Lite_Website_Successful_Url |

Success End Url | 255 |

URL to pass control back to upon successful completion of a transaction. Control of the transaction is passed back to this URL if the Lite_Payment_Card_Status = 0 |

Lite_Website_Fail_Url |

Failed End Url |

255 |

URL to pass control back to if the authorisation is refused by the financial institution. Control of the transaction is passed back to this URL if the Lite_Payment_Card_Status is anything other than 0, 1, 2, 5, 9 or 255 |

Lite_Website_TryLater_Url |

Network error End Url | 255 |

URL to pass control back to if there is a system error which could be overcome by trying again later. Control of the transaction is passed back to this URL if the Lite_Payment_Card_Status = 1, 2, 5 or 9 |

Lite_Website_Error_Url |

Code error End Url | 255 |

URL to pass control back to if the form has not been filled in correctly of there is an inconsistency in the form. Control of the transaction is passed back to this URL if the Lite_Payment_Card_Status = 255 |

Lite_Order_LineItems_Product_# |

LineItem | 255 |

Line item of what is being ordered. The # indicates a number starting at 1 and incrementing by 1 for every line item. This is essentially a description of the item being ordered |

Lite_Order_LineItems_Quantity_# |

LineQuantity | 10 |

Line item Quantity of what is being ordered. The # indicates a number starting at 1 and incrementing by 1 for every line item. This is the number of units being ordered. |

Lite_Order_LineItems_Amount_# |

LineAmount | 10 |

Line item cost including tax if any of what is being ordered. The # indicates a number starting at 1 and incrementing by 1 for every line item. This is the unit price for this particular item. |

Lite_ConsumerOrderID_PreFix |

Autogenerate Invoice Extension | 5 |

If the Merchant sets the ECOM_CounsuremOrderID to “AUTOGENERATE" then this field is used to control the first 3 to 6 characters of the autogenerated consumerorderid E.g. “INV” set in this field will result in an autogenerated consumerorderid of “INV0001”, “INV0002” and so on. |

Ecom_BillTo_Online_Email |

Bill to email | 40 |

This is the email address the invoice would be mailed to. e.g., jsmith@isp.com |

Ecom_Payment_Card_Protocols |

Payment protocols available | 20 |

A space separated list of protocols available for a specified card. Initial list of case insensitive tokens: "none", "set", or "setcert". "Set" indicates usable with SET Protocol (i.e., is in a SET wallet) without a SET certificate. "Setcert" indicates same but does have a SET certificate. "None" indicates standard is being used but wallet is not SET capable or the card has not been entered into the SET wallet. Usually a hidden field. |

Ecom_ConsumerOrderID |

Consumer generated order ID | 20 |

unique order ID generated by the consumer software. If at all possible, this should be filled out. If it is impossible iVeri will generate one for you but it should preferably be filled out by the merchant. For iVeri to create a unique ordered for you please set this to "AUTOGENERATE" and refer to the Lite_ConsumerID_PreFix which enables you to specify the first few letters of the invoice |

Ecom_TransactionComplete |

End transaction flag | - |

A flag to indicate that this web page/aggregate is the final one for this transaction. Usually a hidden field. |

Optional Parameters:

Name |

General Description |

Length |

Notes |

Lite_Version |

Version |

5 |

Set to current Version number ex. 4.0, for Old Version left blank – Not available. |

Lite_Payment_Card_Status |

iVeri Status |

10 |

Status of transaction received in response |

Lite_Merchant_Trace |

MerchantTrace |

64 |

Unique merchant identification for the request. This value can be used by the merchant to confirm the status of the transaction if need be. Appendix D |

Lite_Recurring_Payment |

CardHolderPresence |

5 |

Set to True or False. If True, then if your ApplicationID has been enabled for Recurring transactions, this will be the first transaction. Note: Your ApplicationID has to be enabled for recurring payments otherwise this indicator will be ignored. |

Lite_Order_Terminal |

Terminal on the Web |

8 |

|

Lite_Order_DiscountAmount |

Discount |

10 |

this is the discount field for iVeri lite, this field should be used as a discount field for the entire shopping basket. Please make use of this field and remember to adjust the Lite_Order_Amount |

Lite_Order_AuthorisationCode |

Authorisation Code |

6 |

Pre-authorisation code received from a financial institution |

Lite_Order_BudgetPeriod |

Budget Period |

2 |

Request to put this order onto a budget plan. The normal options for this are 0, 6, 12, 18, 24 and 36. 0 indicating to budget period. Specifying this field does not guarantee that the request will be granted a budget period |

Lite_Authorisation |

Card Pre-Auth Mode |

5 |

Set to True or False. If True then a Authorisation will be made, if false a Debit will be made. The Authorisation code will be stored for 3 weeks before you need to confirm the transaction in the BackOffice under view orders. |

Lite_Transaction_Token |

Transaction Token |

32 |

Merchant should generate the token: Encoded data should be Lite_Order_Amount, Lite_Merchant_ApplicationId, Ecom_BillTo_Online_Email & TimeStamp |

Ecom_ShipTo_Postal_Name_Prefix |

Ship-to title |

4 |

e.g., Mr., Mrs., Ms.; field commonly not used |

Ecom_ShipTo_Postal_Name_First |

Ship-to first name |

15 |

|

Ecom_ShipTo_Postal_Name_Middle |

Ship-to middle name |

15 |

|

Ecom_ShipTo_Postal_Name_Last |

Ship-to last name |

15 |

|

Ecom_ShipTo_Postal_Name_Suffix |

Ship-to name suffix |

4 |

e.g., Ph.D., Junior, Esquire; field commonly not used |

Ecom_ShipTo_Postal_Street_Line1 |

Ship-to street1 |

20 |

|

Ecom_ShipTo_Postal_Street_Line2 |

Ship-to street2 |

20 |

|

Ecom_ShipTo_Postal_Street_Line3 |

Ship-to street3 |

20 |

|

Ecom_ShipTo_Postal_City |

Ship-to city |

22 |

|

Ecom_ShipTo_Postal_StateProv |

Ship-to state or province |

2 |

2 characters are the minimum for the US and Canada, other countries may require longer fields; for the US use 2-character US Postal state abbr |

Ecom_ShipTo_Postal_PostalCode |

Ship-to zip or postal code |

14 |

|

Ecom_ShipTo_Postal_CountryCode |

Ship-to country |

2 |

use ISO 3166 2 letter codes for country names |

Ecom_ShipTo_Telecom_Phone_Number |

Ship-to phone |

10 |

10 digits are the minimum for the US and Canada, other countries may require longer fields, recommend placing on "x" before an extension |

Ecom_ShipTo_Online_Email |

Ship-to email |

40 |

e.g., jsmith@isp.com |

Ecom_BillTo_Postal_Name_Prefix |

Bill-to title |

4 |

e.g., Mr., Mrs., Ms.; field commonly not used |

Ecom_BillTo_Postal_Name_First |

Bill-to first name |

15 |

If this is blank your invoice would read Dear Customer |

Ecom_BillTo_Postal_Name_Middle |

Bill-to middle name |

15 |

may also be used for middle initial |

Ecom_BillTo_Postal_Name_Last |

Bill-to last name |

15 |

|

Ecom_BillTo_Postal_Name_Suffix |

Bill-to name suffix |

4 |

e.g., Ph.D., Junior, Esquire; field commonly not used |

Ecom_BillTo_Postal_Street_Line1 |

Bill-to street1 |

20 |

|

Ecom_BillTo_Postal_Street_Line2 |

Bill-to street2 |

20 |

|

Ecom_BillTo_Postal_Street_Line3 |

Bill-to street3 |

20 |

|

Ecom_BillTo_Postal_City |

Bill-to city |

22 |

|

Ecom_BillTo_Postal_StateProv |

Bill-to state or province |

2 |

2 characters are the minimum for the US and Canada, other countries may require longer fields; for the US use 2-character US Postal state abbr |

Ecom_BillTo_Postal_PostalCode |

Bill-to zip or postal code |

14 |

|

Ecom_BillTo_Postal_CountryCode |

Bill-to country |

2 |

use ISO 3166 2 letter codes for country names |

Ecom_BillTo_Telecom_Phone_Number |

Bill-to phone |

10 |

10 digits are the minimum for the US and Canada, other countries may require longer fields, recommend placing on "x" before an extension |

Ecom_ReceiptTo_Postal_Name_Prefix |

Receipt-to title |

4 |

e.g., Mr., Mrs., Ms.; field commonly not used |

Ecom_ReceiptTo_Postal_Name_First |

Receipt-to first name |

15 |

|

Ecom_ReceiptTo_Postal_Name_Middle |

Receipt-to middle name |

15 |

may also be used for middle initial |

Ecom_ReceiptTo_Postal_Name_Last |

Receipt-to last name |

15 |

|

Ecom_ReceiptTo_Postal_Name_Suffix |

Receipt-to name suffix |

4 |

e.g., Ph.D., Junior, Esquire; field commonly not used |

Ecom_ReceiptTo_Postal_Street_Line1 |

Receipt-to street1 |

20 |

|

Ecom_ReceiptTo_Postal_Street_Line2 |

Receipt-to street2 |

20 |

|

Ecom_ReceiptTo_Postal_Street_Line3 |

Receipt-to street3 |

20 |

|

Ecom_ReceiptTo_Postal_City |

Receipt-to city |

22 |

|

Ecom_ReceiptTo_Postal_StateProv |

Receipt-to state or province |

2 |

2 characters are the minimum for the US and Canada, other countries may require longer fields; for the US use 2-character US Postal state abbr |

Ecom_ReceiptTo_Postal_PostalCode |

Receipt-to zip or postal code |

14 |

|

Ecom_ReceiptTo_Postal_CountryCode |

Receipt-to country |

2 |

use ISO 3166 2 letter codes for country names |

Ecom_ReceiptTo_Telecom_Phone_Number |

Receipt-to phone |

10 |

10 digits are the minimum for the US and Canada, other countries may require longer fields, recommend placing on "x" before an extension |

Ecom_ReceiptTo_Online_Email |

Receipt-to email |

40 |

e.g., jsmith@isp.com |

Ecom_Payment_Card_Type |

Card type |

4 |

use the first 4 letters of the association name: American Express=AMER; Diners Club=DINE; Discover=DISC; JCB=JCB; Mastercard=MAST; Visa=VISA; other association names may require more than 4 characters. You can tell card numbers apart from the first digit of a credit card number. 3 - American Express 4 - Visa 5 - MasterCard |

Ecom_SchemaVersion |

schema version number |

30 |

Identifies the ecom schema version number; format 999_99; digit (3) _digit (2); defined within a URL (e.g. http://www.w3c.org/ecom/1_0). Field should be included on every page with an ECML field on it and is usually a hidden field. |

Lite_Result_Description |

Description lite transaction |

255 |

Status of transaction described, if any error – error description. |

MerchantReference |

consumer generated order ID |

20 |

unique order ID generated by the consumer software. If at all possible, this should be filled out. If it is impossible iVeri will generate one for you but it should preferably be filled out by the merchant. For iVeri to create a unique ordered for you please set Lite_ConsumerID to "AUTOGENERATE" and refer to the Lite_ ConsumerOrderID PreFix which enables you to specify the first few letters of the invoice. |

Lite_BankReference |

Bank Reference |

11 |

Cycle, Trace number eg. 12345,12345 |

Lite_TransactionDate |

Transaction Date |

|

The date the authorisation took place |

Lite_Referrer |

Referrer |

|

The Website Referrer where the merchants Transaction started |

Lite_Currency_AlphaCode |

Currency |

3 |

The Currency in which the transaction will be processed |

Note: The below fields are required when Implementing

section Tokenisation: TransactionIndex on Subsequent Transactions

Name |

General Description |

Length |

Notes |

Lite_PanFormat |

PanFormat |

64 |

Methodology that specifies how to obtain the PAN details |

Lite_TransactionIndex |

TransactionIndex |

38 |

Unique identifier allocated by iVeri for a series of related transactions. If PANFormat is 'TransactionIndex', TransactionIndex is used to locate a previous transaction for the PAN to be resolved. |

Ecom_Payment_Card_Number |

CardNumber |

20 |

A dotted Pan number as returned in a previous transaction would have to be passed in this field |

Note: The following fields will be used when submitting to CyberSource for Advanced Fraud Screening and will not be saved to the iVeri system.

Name |

General Description |

Length |

Notes |

Lite_Order_LineItems_PassengerFirstName_# |

Passenger FirstName |

60 |

Passenger's first name |

Lite_Order_LineItems_PassengerLastName_# |

Passenger LastName |

60 |

Passenger's last name |

Lite_Order_LineItems_PassengerID_# |

Passenger ID |

32 |

ID of the passenger to whom the ticket was issued. For example, you can use this field for the frequent flyer number |

Lite_Order_LineItems_PassengerStatus_# |

Passenger Status |

32 |

Your company's passenger classification, such as with a frequent flyer program. In this case, you might use values such as standard, gold, or platinum. |

Lite_Order_LineItems_PassengerType_# |

Passenger Type |

32 |

Passenger classification associated with the price of the ticket. You can use one of the following values: • ADT: Adult • CNN: Child • INF: Infant • YTH: Youth • STU: Student • SCR: Senior Citizen • MIL: Military |

Note: The following Airline addendum data is additional transaction data which appear on a card holder's statement when buying a ticket from an airline merchant who include this data in a transaction request

Name |

General Description |

Length |

Notes |

Airline_PassengerName |

Passenger Name |

20 |

Passenger name as printed on ticket. |

Airline_PrimaryTicketNumber |

Primary TicketNumber |

15 |

The ticket numbers. |

Airline_FirstDepartureLocationCode |

First Departure LocationCode |

3 |

Code for departure airport location, eg. JNB for Johannesburg |

Airline_FirstArrivalLocationCode |

First Arrival LocationCode |

3 |

Code for destination airport location, eg. JNB for Johannesburg |

Airline_PNRNumber |

PNR Number |

6 |

|

Airline_OfficeIATANumber |

Office IATA Number |

8 |

The office IATA number |

Airline_OrderNumber |

Order Number |

8 |

The order number |

Airline_PlaceOfIssue |

Place of Issue |

20 |

The ticket office location |

Airline_DepartureDate |

Departure Date |

8 |

Date of departure in yyyymmdd format |

Airline_DepartureTime |

Departure Time |

15 |

Departure time of the first leg of the trip. Use one of the following formats: |

Airline_CompleteRoute |

Complete Route |

25 |

Concatenation of individual travel legs in the format ORIG1-DEST1[: ORIG2-DEST2...:ORIGn-DESTn], f or example:CPT-JNB :JNB-:NBO. For airport codes |

Airline_JourneyType |

Journey Type |

25 |

Type of travel, for example: one way or round trip. |

Note: The following fields will be captured when the merchant’s website transfers control to the Lite web page on the iVeri Gateway.

Name |

General Description |

Length |

Notes |

Ecom_Payment_Card_Number |

card number |

19 |

The card number embossed on the cardholder’s card |

Ecom_Payment_Card_Verification |

cardholder verification value |

4 |

additional cardholder verification number such as American Express' CIV, MasterCard's CVC2, and Visa's CVV2 values |

Ecom_Payment_Card_ExpDate_Month |

card expiration date month |

2 |

Jan - 1, Feb - 2, March - 3, etc. |

Ecom_Payment_Card_ExpDate_Year |

card expiration date year |

4 |

Value in wallet cell is always 4 digits, e.g., 1999, 2000, 2001 |

Ecom_Payment_Card_Name |

name on card |

30 |

name of cardholder |

NOTE: Please remember to do the relevant configuration of the card capture page in BackOffice.

Refer to the Lite BackOffice user guide.

Query Transaction Status

Note: This is just an extra step that can be used by the Merchant to make sure about the Transaction results. We would recommend that a Merchant should use this as a call to make sure the results he received back from the Authorization (Debit) of a transaction are consistent with the results returned here. The URL to post to is defined under the Gateway Addresses

The response to the Authorisation Information request is the following:

- Lite_Merchant_ApplicationId

- Lite_Merchant_Trace

- Ecom_Payment_Card_Number

- Ecom_Payment_Card_ExpDate_Month

- Ecom_Payment_Card_ExpDate_Year

- MerchantReference

- Lite_Order_Amount

- Lite_Order_BudgetPeriod

- Lite_Order_Terminal

- Lite_Order_AuthorisationCode

- Lite_BankReference

- Lite_TransactionDate

- Lite_TransactionIndex

- Lite_Payment_Card_Status

- Lite_Result_Description

Transaction Notification

Email to Merchant

This is an order confirmation from the Payment Gateway to Lite Application.

We have received the following Sale from your customer:

Customer Details:

Name : Mr. John Doe

Email : John

Payment Details:

Transaction Type : Sale

Transaction Index : A0394EB4-BBC1-4567-BBCB-A56B702050DD

Merchant Reference : LITE0000028

Card Number : 4242........4242

Expiry Date : 092025

Acquirer Reference : 80903:09089990

Electronic Commerce Indicator : SecureChannel

Order Details:

Purchase DateTime : 2022-09-03 09:08:32

Total Order Amount : R 100.00

Line Item Details:

Item Description Quantity Unit Cost Line Total

-----------------------------------------------------

Donation product#1 1 100.00 100.00

Additional Info:

Please contact <Distributor> should you have any queries.

Email to card holder

Dear Mr. John Doe

This is to confirm that <MERCHANT NAME> Lite Application has made a Sale on your card (number: 4242........4242) for R 0.99.

The transaction occurred at 2022-08-14 10:13:27 (South Africa Standard Time).

The reference number used by <MERCHANT NAME> Lite Application was <App Id>

Order Details

Purchase DateTime : 2022-08-14 10:13:27

Total Order Amount : R 0.99

Line Item Details:

Item Description Quantity Unit Cost Line Total

-----------------------------------------------------

Donation product#1 1 0.35 0.35

Donation product#2 2 0.32 0.64

Additional Info:

Expiry Date Month : 09

Expiry Date Year : 2025

Should you have any concerns about this transaction or the services offered by<MERCHANT NAME> 's Lite Application, please contact <MERCHANT NAME> 's Lite Application directly.

Additional Variables

Note: These are form variables that are not part of the iVeri Lite specification but may be required by the merchant.

These form variables (if used) will be returned to the website together with all the iVeri Lite form variables.

For added security, to prevent possible fraud by someone obtaining the websites return URL and parameters, we highly recommend that you submit an additional form variable of arbitrary name chosen by the merchant and random value which changes from transaction to transaction. This will be returned to the website along with all the iVeri Lite form variables and all you need to do is check for the existence of the form variable and that the value thereof is the same as that generated and used during the submission of the iVeri Lite page

Introduction to 3D Secure

3D secure (Secure Code or Verified by Visa), is all about call back protection and making sure card holders are who they say they are. The Illustration and process that follows, shows 3D secure in use as implemented by Merchants using iVeri Enterprise and not iVeri Lite. Illustrating the process in this way, helps to show how each entity is involved even if certain functions are performed on behalf of Merchants using iVeri Lite.

3D secure transaction process flow

- Cardholder is on the merchant’s checkout page, ready to pay for their order. They will input and submit their card details on the payment page hosted by the Gateway.

- The Gateway will proceed to check if the card in use is enrolled in 3DS by sending a request to the Directory Server.

- Directory Server will respond with enrollment status.

Considering the response is positive and the card is enrolled for 3DS, - The Gateway will redirect to the issuer ACS for authentication

The ACS will prompt the cardholder to insert and submit OTP/Password/credential(etc.) - Considering the authentication was successful, the response is returned to the gateway to confirm successful authentication

- Gateway then forwards the transaction details to the acquirer for authorization (Debit)

- The acquirer sends an authorization request to the issuer

- Issuer authorizes the transaction and sends response to the acquirer

- Acquirer sends response to the Gateway

- Gateway in turn reflects the response to the merchant by calling corresponding callback url set by the merchant in their implementation.

Tokenisation: Transactionindex On Subsequent Transactions

This section explains how to implement a follow up/subsequent transaction using the TransactionIndex returned from an initial/previous transaction processed successfully.

Merchants that wish to accept payments from regular customers without worrying about PCI DSS burdens of storing or retaining the card number have an option of submitting a unique identifier associated with the customers card number from a previously successfully processed transaction. In iVeri's realm, the identifier which the merchant can pass on subsequent transactions is called the “TransactionIndex”. This variable is an iVeri Gateway generated identifier commonly found in Gateway responses to the merchant.

Initial Transaction

When a merchant sends a transaction request(POST) to the iVeri Gateway, the response returned to the merchant generally contains a number of variables, some of which are important when performing subsequent transactions, in order for the merchant to implement subsequent transactions the following variables must be stored on the merchants database.

- Lite_TransactionIndex

- Ecom_Payment_Card_Number

- Ecom_Payment_Card_ExpDate_Month

- Ecom_Payment_Card_ExpDate_Year

Subsequent Transactions

When TransactionIndex is used on subsequent transactions, regular customers do not have to re-supply the card data details however this ONLY works if the merchant developer has made provisions for the following:

- Ability for the merchant to identify the customer, usually by means of user sign-in

- The merchant has successfully processed a transaction on the customers card at some point in time using the iVeri Gateway

- That the customer's profile is mapped to the correct Tokenised card details (TransactionIndex, Expiry date etc) returned on the initial or previously processed transaction

Once the above provisions are made, the merchant developer would be able to display to the cardholder a masked/dotted card number and the expiry date of the card. The cardholder would simply select the masked card on file and make a payment.

Subsequent Transactions implementation

On the request to the Gateway, the merchant developer has to pass all the required variables that pertain to a subsequent transaction so as to make sure that the iVeri Gateway handles the request appropriately.

Variables that should be present in the request to the iVeri Gateway are as follows:

- The Lite_PanFormat must be set to TransactionIndex

- Set the Lite_TransactionIndex to the actual TransactionIndex value e.g {000000-000000- 000-0000 0000000}

- Set the Ecom_Payment_Card_Number to the Dotted PAN value

Note: These variables are defined in 8.2 iVeri specification. In addition to these the merchant will still need to pass all the other required variables.

Merchant Hash Token Generation

Then merchant token generation is a security measure introduced to hash merchant and transaction specific data elements, using SHA256 hashing algorithm. An effort which reduces the risk of data being exposed or intercepted by 3rd parties during the submission of transaction requests to the gateway.

Prerequisites

The below parameters must be set in the merchant Backoffice

- Enable Token Verification to “Yes” (By default this parameter is set to “No”)

- Populate the Lite Shared Secret key parameter. Maximum length 32 characters (alpha-numeric)

Requirements

Merchants must generate the token on their web server and pass the generated token to the transaction request. The generated token must encompass the following data elements:

- Lite_Order_Amount: Total amount of the order as specified in 8.2

- Lite_Merchant_ApplicationId – The merchants app ID as specified in 8.2

- Ecom_BillTo_Online_Email – Email of the cardholder as specified in 8.2

- TimeStamp – The timestamp when the token is generated

Token Verification Logic in the Hosted Payment Page

- If Enable Token Verification has been set to YES and Lite Shared Secret has not been set an exception will be thrown when submitting a transaction request

- If Enable Token Verification has been set to YES and Lite_Transaction_Token has not been set an exception will be thrown when submitting a transaction request

- If Enable Token Verification has been set to YES and the Lite_Transaction_Token does not match the calculated token an exception will be thrown

Merchant Hash Token Generation

Sample Code:

VISA Checkout with Lite

Visa Check-Out is a digital representation of a cardholders Visa Card. Cardholders can register their debit or credit cards by downloading the Visa Check-Out app. Once cardholders have their profiles and card details loaded in Visa Check-out, they are able to make purchases at merchants who are accepting with Visa Check-Out payments.

The Visa Check Out process flow explained below showcases the different parties involved.

Process Flow in Visa Check-Out with Lite

- Cardholder selects Visa Check-Out as payment method

- iVeri Lite calls Visa Light Box or Widget and presents it to the Cardholder to Login

- Cardholder Logins via Visa Light Box

- Cardholder selects a card and presses Continue

- Upon clicking Continue, iVeri Lite receives a Call ID (uniquely identifies the transaction)

- iVeri Lite uses the Call ID to get the Payload from Visa services

- Payload is returned by Visa services to iVeri Lite

- iVeri Lite decrypts the Payload and retrieves the PAN

- iVeri Lite sends the transaction request to the gateway/acquire

- When the response is received, Visa services is updated with either a Failed or Successful response

- Lastly, a redirect to the merchant with the transaction response is made.

Illustration of Visa Check-Out Process With iVeri Lite

MasterPass

MasterPass is a safe and easy way in which merchants can present the QR code which customers can scan using a MasterPass application to affect a payment.

Requirements

Merchant must be onboarded for MasterPass on the iVeri Gateway and on the MasterPass platform.

Query Code

Function: Query a code that has been created.

Query Code Parameters

|

Request Parameter |

Description |

|

MasterPassAction |

Mandatory, The action to perform. |

|

MasterPassMerchantID |

Mandatory, The merchant id as captured on MasterPass. |

|

MasterPassCode |

Mandatory, The result code that must be queried |

|

Response Parameter |

Description |

|

MasterPassAction |

The action that was performed |

|

MasterPassShortDescription |

Short decription linked to the code |

|

MasterPassCodeExpiryDate |

Date until the code is valid. This is in epoch time. |

|

MasterPassMerchantName |

The name of the merchant as captured on MasterPass |

|

Amount |

Amount linked to the code. |

|

Currency |

The currency is tied to the merchant setup. |

|

MerchantReference |

Linked to the code. |

Query Code – REST Sample

|

Request |

Response |

|

{ "Version": "2.0", "CertificateID": "{xxxxxxxx-71dd-4044-802d-xxxxxxxxxxxx}", "ProductType": "Enterprise", "Direction": "Request", "Enquiry": { "ApplicationID": "{xxxxxxxx-68e0-42eb-aba9-xxxxxxxxxxxx}", "Mode": "Live", "command":"MasterPassQuickResponseCode", "MasterPassMerchantID": "xxxxx", "MasterPassAction": "QueryCode", "MerchantReference": "Ref_001", "MasterPassCode":"xxx2720xxx" } }

|

{ "Version": "2.0", "Direction": "Response", "Enquiry": { "Currency": "R", "MerchantReference": "Ref_001", "Amount": "1075", "MasterPassAction": "QueryCode", "MasterPassShortDescription": "Basket of goods", "MasterPassCodeExpiryDate": "1645187074000", "MasterPassMerchantName": "Retail Merchant 001", "ApplicationID": "{xxxxxxxx-68E0-42EB-ABA9-xxxxxxxxxxxx}", "Command": "MasterPassQuickResponseCode", "Mode": "Live", "RequestID": "{xxxxxxxx-2207-4C11-A89C-xxxxxxxxxxxx}", "Result": { "Status": "0", "Code": "0", "Description": "", "AppServer": "QAGW2012APP1", "DBServer": "QAGW2012DB2", "Gateway": "QA" } } }

|

Query Code –SOAP Sample

|

Request |

Response |

|

<soap:Envelope xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xmlns:xsd="http://www.w3.org/2001/XMLSchema" xmlns:soap="http://schemas.xmlsoap.org/soap/envelope/"> <soap:Body> <Execute xmlns="http://iveri.com/"> <validateRequest>false</validateRequest> <protocol>V_XML</protocol> <protocolVersion>7.0</protocolVersion> <request><V_XML Version="2.0" CertificateID="xxxxxxxx-71dd-4044-802d-xxxxxxxxxxxx" ProductType="Enterprise" ProductVersion="iVeriWebService" Direction="Request"> <Enquiry ApplicationID="xxxxxxxx-68e0-42eb-aba9-xxxxxxxxxxxx" Command="MasterPassQuickResponseCode" Mode="LIVE"> <MerchantReference>Ref_002</MerchantReference> <MasterPassMerchantID>xxxxx</MasterPassMerchantID> <MasterPassAction>QueryCode</MasterPassAction> <MasterPassCode>xxx5104xxx</MasterPassCode> </Enquiry> </V_XML> </request> </Execute> </soap:Body> </soap:Envelope>

|

<?xml version="1.0" encoding="utf-8"?><soap:Envelope xmlns:soap="http://schemas.xmlsoap.org/soap/envelope/" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xmlns:xsd="http://www.w3.org/2001/XMLSchema"><soap:Body><ExecuteResponse xmlns="http://iveri.com/"><ExecuteResult><V_XML Version="2.0" Direction="Response"> <Enquiry ApplicationID="{xxxxxxxx-68E0-42EB-ABA9-xxxxxxxxxxxx}" Command="MasterPassQuickResponseCode" Mode="Live" RequestID="{xxxxxxxx-55EC-4835-9817-xxxxxxxxxxxx}"> <Result Status="0" Code="0" Description="" AppServer="QAGW2012APP1" DBServer="QAGW2012DB2" Gateway="QA" /> <Currency>R</Currency> <MerchantReference>Ref_002</MerchantReference> <Amount>1075</Amount> <MasterPassAction>QueryCode</MasterPassAction> <MasterPassShortDescription>TestProduct</MasterPassShortDescription> <MasterPassCodeExpiryDate>1647898033000</MasterPassCodeExpiryDate> <MasterPassMerchantName>Sample Merchant Enterprise Enterprise</MasterPassMerchantName> </Enquiry> </V_XML></ExecuteResult></ExecuteResponse></soap:Body></soap:Envelope |

Delete Code

Function: Delete a code that has been created

Delete Code Parameters

|

Request Parameter |

Description |

|

MasterPassAction |

Mandatory, The action to perform. |

|

MasterPassMerchantID |

Mandatory, The merchant id as captured on MasterPass. |

|

MasterPassCode |

Mandatory, The result code that must be deleted |

|

Response Parameter |

Description |

|

MasterPassAction |

The action that was performed |

Delete Code – REST Sample

|

Request |

Response |

|

{ "Version": "2.0", "CertificateID": "{xxxxxxxx-71dd-4044-802d-xxxxxxxxxxxx}", "ProductType": "Enterprise", "Direction": "Request", "Enquiry": { "ApplicationID": "{xxxxxxxx-68e0-42eb-aba9-xxxxxxxxxxxx}", "Mode": "Live", "command":"MasterPassQuickResponseCode", "MasterPassMerchantID": "xxxxx", "MasterPassAction": "DeleteCode", "MerchantReference": "Ref_001", "MasterPassCode":"0790455080" } }

|

{ "Version": "2.0", "Direction": "Response", "Enquiry": { "MasterPassAction": "DeleteCode", "ApplicationID": "{xxxxxxxx-68E0-42EB-ABA9-xxxxxxxxxxxx}", "Command": "MasterPassQuickResponseCode", "Mode": "Live", "RequestID": "{xxxxxxxx-1DC1-4D06-A632-xxxxxxxxxxxx}", "Result": { "Status": "0", "Code": "0", "Description": "", "AppServer": "QAGW2012APP1", "DBServer": "QAGW2012DB2", "Gateway": "QA" } } }

|

Delete Code –

SOAP Sample

|

Request |

Response |

|

<soap:Envelope xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xmlns:xsd="http://www.w3.org/2001/XMLSchema" xmlns:soap="http://schemas.xmlsoap.org/soap/envelope/"> <soap:Body> <Execute xmlns="http://iveri.com/"> <validateRequest>false</validateRequest> <protocol>V_XML</protocol> <protocolVersion>7.0</protocolVersion> <request><V_XML Version="2.0" CertificateID="xxxxxxxx-71dd-4044-802d-xxxxxxxxxxxx" ProductType="Enterprise" ProductVersion="iVeriWebService" Direction="Request"> <Enquiry ApplicationID="xxxxxxxx-68e0-42eb-aba9-xxxxxxxxxxxx" Command="DeleteCode" Mode="LIVE"> <MerchantReference>Ref_002</MerchantReference> <MasterPassMerchantID>xxxxx</MasterPassMerchantID> <MasterPassAction>DeleteCode</MasterPassAction> <MasterPassCode>xxx5104xxx</MasterPassCode> </Enquiry> </V_XML> </request> </Execute>

|

<?xml version="1.0" encoding="utf-8"?><soap:Envelope xmlns:soap="http://schemas.xmlsoap.org/soap/envelope/" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xmlns:xsd="http://www.w3.org/2001/XMLSchema"><soap:Body><ExecuteResponse xmlns="http://iveri.com/"><ExecuteResult><V_XML Version="2.0" Direction="Response"> <Enquiry ApplicationID="{xxxxxxxx-68E0-42EB-ABA9-xxxxxxxxxxxx}" Command="DeletCode Mode="Live" RequestID="{xxxxxxxx-304D-4EB0-882D-xxxxxxxxxxxx}"> <Result Status="0" Code="0" Description="" AppServer="QAGW2012APP1" DBServer="QAGW2012DB2" Gateway="QA" /> <MasterPassAction>DeleteCode</MasterPassAction> </Enquiry> </V_XML></ExecuteResult></ExecuteResponse></soap:Body></soap:Envelope> |

Distributors Contact Information

Below is the contact information per distributor for registering billing and banking details with iVeri. An iVeri Distributor markets the services of the iVeri Gateway and products within a locality.

Nedbank South Africa

Location: South Africa

Telephone: 0860 114 966

Websites: http://www.iveri.co.za/ | http://www.nedbank.co.za/

Email:

· Technical Assistance operations@iveri.com

· Non-technical requests/questions (e.g. costs, agreements, product information etc): info@iveri.co.za

Nedbank Namibia

Location: Namibia

Websites: http://www.iveri.co.za/ | http://www.nedbank.co.za/

Email:

· Technical Assistance operations@iveri.com

· Non-technical requests/questions (e.g. costs, agreements, product information etc): info@iveri.com

I&M Bank

Location: Kenya

Websites: http://www.iveri.com/ | http://www.imbank.com/KE/

Email:

· Technical Assistance operations@iveri.com

· Non-technical i.e. product information: info@iveri.com

CBZ Bank

Location: Zimbabwe

Websites: http://www.iveri.com/ | http://www.cbzbank.co.zw/

Email:

· Technical Assistance operations@iveri.com

· Non-technical i.e. product information: info@iveri.com

CSC and CSC24Seven Bank

Location: Lebanon & Cyprus

Websites: http://www.iveri.com/ | http://www.cscgroup.com/

Email:

· Technical Assistance operations@iveri.com

· Non-technical i.e. product information: info@iveri.com

CIM Finance

Location: Mauritius

Websites: http://www.iveri.com/ | http://www.cim.mu/

Email:

· Technical Assistance operations@iveri.com

· Non-technical i.e. product information: info@iveri.com